History is the best way to understand many things that are happening in present times. Taxes are a complicated subject for most people, but learning taxation is important in understanding its effects your retirement. Even though you may never want to retire (you will know it when you can’t work anymore), taxes will follow you even after your death certificate has been stamped and filed. Yes, there is such a thing as “death taxes”.

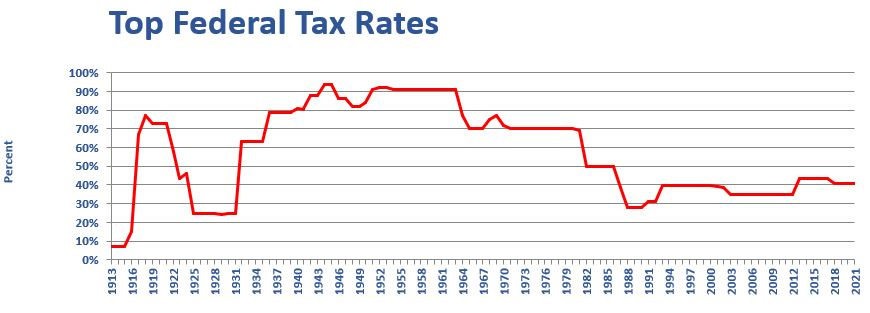

You may be surprised by the fact that currently we are having one of the lowest tax rates in history and that significant tax breaks are scheduled to end on January 1, 2026. Congress will need to act for that not to happen. But think about the huge deficit we have in our country, if we count the added expending generated from stimulus payments to citizens during COVID-19 alone, that creates a huge challenge for congress to lower taxes. They may be forced to increase taxes significantly.

I invite you to think about that four-letter word that can explain everything: MATH. The way the finances of our country are being handled, is like you hoping to put everything on a credit card for your future income whilst unemployed. Even though you may find a regular paying job, it is going to be nearly impossible to pay off all your debt.

We the people in USA are going to pay more taxes in order to pay our bills for generations to come. I invite you to take a look at the tax history in U.S.A.

2 For simplicity, unless otherwise noted, the historical federal income tax rates in this article refer to the highest tax rate.

3 http://data.bls.gov/cgi-bin/cpicalc.pl

4 http://www.irs.gov/pub/irs-soi/05inrate.pdf, p. 8.

As you can see our country has reached very high rates across history. Our present situation as of February 2021 includes an outstanding debt of 27 trillion dollars1. If we add off-books debt (Social Security Pensions, for example) we get a much scarier number. That is what the experts call a FISCAL GAP. The fiscal gap can be up to 100 times more than the “on the books” debt we currently have.

This situation we are currently facing, makes it very difficult to predict how much money one needs to save for retirement. David McKnight said “You can have a million dollars in your IRA but unless you can accurately predict what taxes are going to be in the year you take that money out; you do not really know how much money you have and it is hard to plan for retirement, if you really do not know how much money you have.” I encourage you to watch the movie “The Power of Zero: The Tax Train is Coming” thetaxtrain.com. This movie explains in detail the truthful realities that our country is facing.

At Janix Assurance, we advise in order to create sound strategies that might remove you from the Tax Train track that is coming for all of us, by insulating and buffering you from the impact of future higher taxes. As you know there are different venues for investment to save for retirement. All those types of investments fit only in three types of accounts: We explain it here as buckets of money.

- TAXABLE BUCKET: Here, every year your money grows you pay a tax. (Stocks, bonds, mutual funds, CDs, Money Market Accounts. If you have too much money here, you have the risk of paying higher taxes. That it does not count the management fee-based that some of your accounts are subject to. “You may have too much money in this bucket from the tax efficiency prospective” (David McKnight). Here we advise you have just the right amount for emergency money.

- TAX DEFERRED BUCKET: Here, you pay the taxes at the time you withdraw the money (401k, IRAs, 457, SEP simples, 403b). The most important question for this type of bucket is what it will the tax rate be when you take your money out. Remember the tax is not deferred, is postponed! What it happens here is that the money will get taxed on the harvest not the seed. That means higher taxes because the government will need higher taxes to pay its deficit.

The IRS will want you to take the minimum required distributions at age 70 ½ . If that does not happen, you get a tax penalty of 50% plus Federal Income Tax let say 30%, there goes 80% of your money!

When you take too much money from your tax deferred bucket the IRS tracks your money with the provisional income to determine if they tax your social security income.

What counts towards the provisional income? 1099s, distributions from your tax deferred bucket, and ½ of your social security income. For 2021 social security tax is 85% for a single person with income of $34,000 or greater and married couples filing jointly with income of $44,000 or greater.

Just think what it happens when your social security gets taxed… You guest it! You run out the money faster!

Janix Assurance will help you to plan to have the right amount in your deferred tax bucket to minimize or avoid the social security taxation.

- TAX FREE BUCKET: In order to qualify money for this bucket is necessary that it is not subject to federal/state income taxes, social security taxes, and capital gains taxes. At Janix Assurance, we will guide you in the right direction to allocate your money in the best tax-free alternatives available to you and your family.

Your goal for your retirement should be to have a sustainable retirement distribution with less or none of the tax burden that affects the longevity of your retirement money. We are here when you need us. Please contact us for a non-obligation consultation https://janixlife.com/contact.html

Resources:

- Dave Manuel: U.S National Debt Clock February 2021

https://www.davemanuel.com/us-national-debt-clock.php

- David McKnight: The Power of Zero book

- David McKnight: The Power of Zero: The Tax Train is Coming

- Bradford Tax Institute. History of Federal Income Taxes Rates: 1913 – 2021

https://bradfordtaxinstitute.com/Free_Resources/Federal-Income-Tax-Rates.aspx

- Internal Revenue Service. Tax Summary 2021