How to Protect Your Legacy Before Long-Term Care Becomes a Crisis

If you are in your 50s or early 60s, you are in what I call the “Power Years.”

You are still building. Still earning. Still strong. Still independent.

But this is also the decade when wise people begin preparing for the years when strength may not look the same.

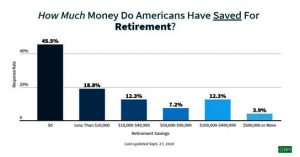

Most families wait too long to think about long-term care or home health care. They assume Medicare will take care of it. They assume savings will be enough. They assume their children will step in.

The truth is more serious than most realize.

The Crude Reality: Long-Term Care Is Not Automatically Covered

Medicare is health insurance. It is not long-term custodial care insurance.

Medicare may cover short rehabilitation after a hospital stay. It does not cover extended nursing home care when someone simply needs help with daily living activities, such as:

- Bathing

- Dressing

- Eating

- Using the restroom

- Mobility assistance

- Supervision for cognitive decline

If someone requires long-term nursing home care and has assets, they are generally not eligible for Medicaid assistance until they have spent down their resources.

That means:

- Savings accounts

- Investment accounts

- Retirement funds

- Certain property assets

May need to be depleted before qualifying for government assistance.

In other words, everything you built over decades can slowly erode to pay for care.

And that erosion can quietly eliminate the legacy you hoped to leave behind.

The Hidden Cost of Waiting

A nursing home can cost thousands of dollars per month. Home health care can also be significant depending on the level of support needed.

If planning is delayed until:

- A diagnosis

- A fall

- A stroke

- Cognitive decline

Options become limited. Premiums increase. Some coverage becomes unavailable. Strategies shrink.

Planning in your 50s and early 60s is not about fear. It is about control.

The Legacy Question Most People Avoid

Ask yourself honestly:

If you needed care for five years, would you want your children to:

- Leave their careers?

- Reduce their income?

- Sacrifice their retirement savings?

- Carry emotional and financial strain?

Some families choose that path. Many regret not preparing differently.

There are strategies that allow you to receive care without forcing your family into difficult decisions.

Understanding Medicaid Spend-Down

To qualify for Medicaid long-term care benefits, individuals generally must meet strict asset and income limits.

This often means:

- Liquidating investments

- Using retirement funds

- Paying privately until assets fall below eligibility thresholds

This is called “spend-down.”

Without advance planning, spend-down can dismantle generational wealth.

Proper planning allows families to legally structure assets, protect portions of wealth, and create funding sources specifically for care.

The Senior Protection Concept

Many people are unaware that there are asset-protection and planning strategies commonly referred to under senior protection frameworks.

These strategies can include:

- Asset repositioning

- Insurance-based long-term care solutions

- Hybrid life insurance with long-term care riders

- Tax-advantaged funding structures

- Proper estate planning coordination

When structured properly, some options allow:

- Tax-free access to funds for qualified long-term care expenses

- Preservation of principal

- A death benefit if care is never needed

This means you can prepare for care without automatically sacrificing your legacy.

Tax-Free Long-Term Care Strategies

Certain financial products allow access to funds on a tax-free basis when used for qualified long-term care expenses.

For example:

- Some life insurance policies with long-term care riders

- Asset-based long-term care plans

- Certain hybrid policies

These can provide:

- Monthly benefits for home health care

- Funds for assisted living

- Coverage for nursing home care

- A residual death benefit if unused

When designed properly, this creates leverage.

Instead of paying entirely out of pocket, you transfer part of the risk to an insurance carrier.

Instead of draining your estate, you create a separate pool of funds for care.

Home Health Care vs Nursing Home

Many people prefer home health care during what I call the “slow years.”

Planning early allows you to choose:

- Aging in place

- Care at home

- Private caregivers

- Assisted living environments

- Higher quality facility options

Without planning, decisions may be made based solely on what can be afforded at the time.

Preparation equals dignity and choice.

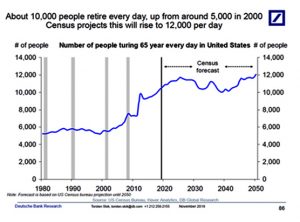

Why Planning Before 65 Matters

Waiting until 70 or 75 can create problems:

- Higher premiums

- Health underwriting challenges

- Fewer product options

- Reduced insurability

Your 50s and early 60s often provide the most favorable window for:

- Qualification

- Cost efficiency

- Strategic design

This is not about buying something blindly.

It is about designing a coordinated plan.

Protecting Your Legacy While Preparing for Care

If leaving a legacy matters to you, planning must happen intentionally.

A proper strategy can help you:

- Protect assets from full spend-down

- Provide tax-efficient funding for care

- Reduce emotional burden on children

- Maintain control over how care is delivered

- Preserve wealth transfer goals

Long-term care planning is not separate from estate planning.

It is part of it.

A Message to the Responsible Planner

If you are reading this in your 50s or early 60s, you are in the perfect position to act wisely.

You still have:

- Time

- Earning capacity

- Health leverage

- Flexibility

Waiting transforms a strategic decision into a reactive emergency.

Planning now transforms uncertainty into clarity.

Final Thought

The greatest gift you can leave your children is not just an inheritance.

It is freedom.

Freedom from financial burden.

Freedom from career disruption.

Freedom from emergency decisions.

Freedom to remember you with gratitude, not stress.

Preparing for long-term care is not about expecting decline.

It is about protecting dignity, independence, and the legacy you worked a lifetime to build.

Authored exclusively by:

© 2026 Janix Barbosa-Llanos, MBA, PMP, CEP, RSSA, FSN

All rights reserved.

National Certified Estate Planner

Registered Social Security Analyst

Financial Security Navigator

Educational Disclosure

This article is provided for informational and educational purposes only. It is not intended as legal, tax, or accounting advice.

I, Janix Barbosa-Llanos, am a licensed insurance professional specializing in home health care planning, long-term care strategies, and retirement protection solutions. I encourage individuals and families to explore their options early, while they still have flexibility, health qualification advantages, and strategic leverage.

Planning ahead allows you to secure appropriate coverage before it becomes urgent, preserving both peace of mind and family harmony.