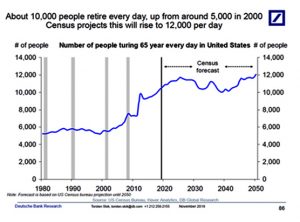

For many, retirement is becoming more and more like a dream. I was looking at the USA Census statistics in 2000. At that time, the number of people retiring per day was 10,000. This means that 3,650,000 people were retired in 2001. The 2020 Census has not started yet, but you can picture the new numbers that are going to show in the next census reports? The projections are 12,000 people a day, which I feel it is extremely conservative.

Have you ever thought what it means to you? How might this trend affect you?

More and more people are banking on social security income to supplement their retirement. The Social Security Administration must provide higher and higher funding to pay for the onslaught of new claimants. We are talking about billions of dollars per year. With the senior citizen count outnumbering the younger generations for first time in history, this means that less and less workforce are available to contribute towards social security. Consequently, the USA debt clock keeps growing exponentially. What are the consequences? TAXES! TAXES! TAXES! and more TAXES!

Seriously! We are living in times with the lowest tax breaks in history! In your opinion, do you feel that taxes are going to be same when you reach retirement age? Do you feel that the retirement crisis we are currently in is going to decrease or increase?

According to an article published in Yahoo Finance by Sean Dennison, 64% of Americans aren’t prepared for retirement and will go broke!

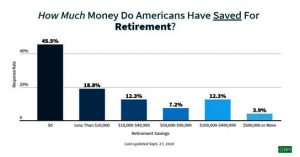

As you can see from this chart, 83.8% of people have less than $100,000 in retirement savings, in addition 45.5% have nothing! Here, we are not referring to any of those people having critical or chronic illnesses with long-term care needs. If you think about it for a minute, who will end up paying for the care of those people? You guessed it! You, through Medicaid! This means that the Federal Government must increase taxes to keep paying for Social Security Income, Medicaid, Medicare and many other programs.

How does this reality make you feel?

Let’s now talk about longevity… General statistics show that an approximately 65 year old man can expect to live approximately 18 years into retirement. Women can expect to live 20 years. In your opinion, how do you think this group of people is doing ensuring appropriate savings? Most people are running out the money and depend only on social security income to survive. What about those dreams people had for retirement? GONE!

If you are a woman, you will need to plan longer than a man, because you will live longer! You and your spouse can start planning now, on how much is needed to save for retirement. The younger you are the more time to accumulate you will have. Use a retirement calculator to begin understanding what realistic number that will be. Once you arrive to that number, it is time to speak with your advisor to discuss solutions that will contribute to tax free retirement distributions.

For more information contact your agent at www.janixlife.com

Copyright – Janix Assurance LLC.

Resources:

Social Security Administration https://www.ssa.gov/planners/taxes.html

USA.GOV https://www.usa.gov/retirement

Yahoo Finance https://finance.yahoo.com/news/